Strong performance in China while other key markets faced covid disruption has helped Huawei claim top spot for Q2

Huawei has overtaken Samsung for the first time after shipping more smartphones for the second quarter of 2020.

That is according to statistics from Canalys which revealed Huawei sold 55.8 million units for the quarter.

Although this figure represented a drop of five per cent year-on-year, it beat Samsung’s 53.7 million shipments, a number which declined a massive 30 per cent.

But Huawei’s performance has been mainly due to a strong performance in its home Chinese market.

Huawei occupied 70 per cent market share in China for Q2, boosting home shipments eight per cent YoY.

However the US sanctions and ongoing disputes because of this has hindered the vendor outside of China, with overseas shipments down 27pc.

Full advantage

Canalys senior analyst Ben Stanton argues that if it wasn’t for the coronavirus outbreak, Huawei wouldn’t have top spot.

“If it wasn’t for COVID-19, it wouldn’t have happened,” said Stanton. “Huawei has taken full advantage of the Chinese economic recovery to reignite its smartphone business

“Samsung has a very small presence in China, with less than one per cent market share, and has seen its core markets, such as Brazil, India, the United States and Europe, ravaged by outbreaks and subsequent lockdowns.”

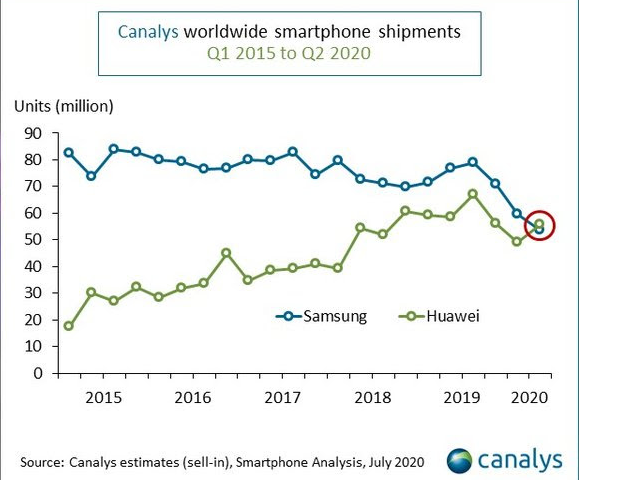

Over the past five years Huawei has closed the gap considerably on Samsung.

Back in Q1 2015, Samsung shipped just over 80 million units compared to Huawei which hadn’t even shipped 20 million.

Canalys analyst Mo Jia added: “Taking first place is very important for Huawei, it is desperate to showcase its brand strength to domestic consumers, component suppliers and developers.

However Jia expects Huawei will struggle to maintain this level of performance, amid ongoing disputes.

“Its major channel partners in key regions, such as Europe, are increasingly wary of ranging Huawei devices, taking on fewer models, and bringing in new brands to reduce risk.

“Strength in China alone will not be enough to sustain Huawei at the top once the global economy starts to recover.”